Yves Smith blogged about post office providing banking services. Here is my take on it.

Buy my books "Subverting Capitalism & Democracy" and "Understanding Firms".

|

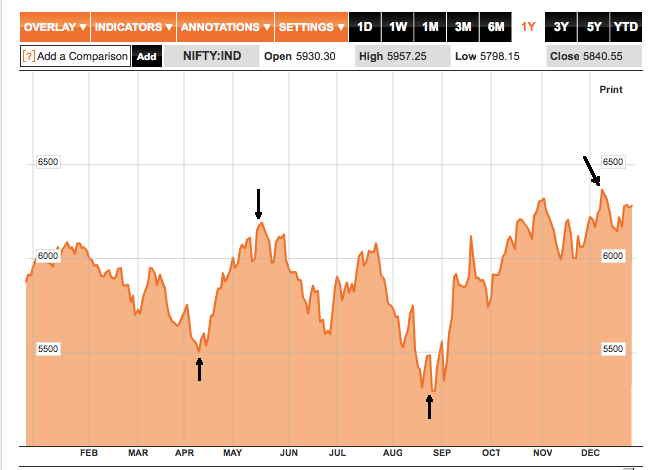

| NIFTY over 2013 calendar (Bloomberg.com) |

To prevent this, central bankers pump in money to compensate the loss in velocity thereby holding the prices level in the economy up. This stabilizes the economy and pacifies the participants. In the current crisis too, US Fed has increased Money supply exponentially as seen in alongside figure (from St. Louis Fed from business insider).

To prevent this, central bankers pump in money to compensate the loss in velocity thereby holding the prices level in the economy up. This stabilizes the economy and pacifies the participants. In the current crisis too, US Fed has increased Money supply exponentially as seen in alongside figure (from St. Louis Fed from business insider).I have been amongst the most pessimistic about the prospects of global economy. There has been a lot of harping about what got us into the current mess. Together the blogosphere has painted a picture of gloom. And now that we have painted this dark tunnel it is time to paint the light and the end of it! It is time to decipher the solution to the crisis.

One of the reason great depression lasted as long as it did was because of delay in acknowledging the solution. The solution was always there - no doubt - but it took time for the solution to win over the decision-makers into coordinated action. Thanks to globalisation and internet based coordination, we should be able to do it faster this time. If only we had the solution - or may be we do!I present my side of solution in next few posts. Let us march towards a light - any light to begin with!

Who can be consumers?Citizens, who have savings and income to replenish the savings post buying goods and services, can be consumers. Rest cannot! That implies the developed world - probably with exception of Germany and Japan, cannot be consumers. China, India, Indonesia and other countries with domestic savings will be our consumers.

Value of consumption

Currently, the exchange rate equations are aligned to repress the consumption behaviour of these populations. In the interest of global recovery these equations will have to be reversed. This will entail a lot of protectionist pressures that are detrimental to consumers. Such measures will wipe out any hint of global recovery.

Not consuming is always an option

Typically protectionist measures reduce the quality of local goods, increase prices and thereby cheat consumers out of their hard earned money. Today, the globalised consumer, is aware of product benchmarks and price parity across geographies. In current situation, consumers may simply "not consume" inferior products. They will choose to increase their savings.

How protectionism is detrimental to the world?

This means the advantages of protectionism will accrue only if it continues for prolonged period of time in near future. Till it continues - global depression will continue. It means you will see more enforcement at customs counters in airports, ports and national borders. It means increased smugling of attractive goods establishing a supply chain for drugs, weapons and other illegal trade. All detrimental in socio-economic terms.

Changing producer competitivenessThe question is invariably based on Michael Porter's work on competitive advantage of nation. The only modification is understanding the structural or fundamental advantages. We need to separate out the transient, artificially imposed advantages. A deliberately devalued currency is such a transient man-made advantage. And it will break down. Michael Pettis, makes a fantastic argument how trade policies can influence producer dispersion.

Who will be new producers?Producers are located due to various competitive advantages of a region. One of the reason is quality and cost of manpower - let us call this man power profile. Similarly we have a job profile of an economy. Job profile, for simplicity sake, is based on technical knowledge pre-requisites and volume of work. Now ideally in sustainable case the job-profile and man-power profile of an economy should match. Currently there is a mismatch in developed world. US and EU jobs are getting polarized between unmovable low value addition activities on one side and exceptionally high value adding activities on other.

Man-power profile will stabilizeThe volume of low-value addition jobs will have to rise in US - to fit with lowering relative education standards. Now education system in US is way better than other nations. So we are simply comparing US in the future to US in recent past. The problem is in very short-term jobs movements are a zero-sum game (time till entrepreneurship discovers new jobs). So it means US wanting jobs will mean job losses in other part of the world. That, to my mind, is a seed of discord in near future. Hope is migrant workers might go back to home countries and US might actually have a brain drain to ease the pressure a wee-bit. In medium to long term US entrepreneurs will definitely figure out a way to create value in new and innovative ways -creating jobs for the economy.

Seamless dispersion of production centersThe intersection of man-power and job profiles will mean a more seamless dispersion of production centers across the world. The first demonstration of this will come when some manufacturing jobs moving back to US.

The global credit channel is a central sysmptoms and collateral damage of current crisis. The core of this is in US and therefore US government agencies are attempting bailout after bailout. The US government is not liable for rescuing an essentially global channel. It's first duty to clean the domestic channel. The two are cross connected to such a degree that they cant tell what they are fixing.

The solution, to my mind, is simple. Create an alternate credit channel - what I call "the modified good bank solution".

- Create a good bank - with regulatory charter that allows lower capital norms, higher government guarantees etc. so that it will have liquidity, capital and ability to acquire assets.

- Let it give credit to worthy borrowers who have the ability to repay.

- Create a mass loan transfer drive - where the borrowers to move their loans to this bank - rather than buying loan books from established banks.

- Accelerate the process by establishing uniform common minimum norms for acquiring loans. Start with lowest risk with highest documentary evidence.

- Augment the document checking using other government agencies workforce.

- Repeat the drives till you have covered big chunk of population. Government can take over some homes and convert them into temporary offices - establish geographically wide network - quickly.

- This bank should be broken up into managable units and privatised at a pre-committed date in 5/7 years time.

The global bailouts are more complex. This should be funded with pooled money. Using the IMF or world bank is a good starting point. More on that later.

Addendum: Why Us needs to fix domestic credit channel first?US is biggest consumer of the world. The world needs able US consumers to continue to spend albeit to their comfort level (and definitely to lesser degree). The able and wanting consumers are currently being denied a chance to consume. This is dtrimental to everyone.

Current problem won't resolve by just establishing an alternate credit channel. Once the US credit channel is available. Credit flows based on certainity of earnings. Economist's View: Galbraith: No Return to Normal indicates how Galbraith points to this critical point. Let me paraphrase Galbraith:In other words, Roosevelt employed Americans on a vast scale, bringing the unemployment rates down to levels that were tolerable, even before the war—from 25 percent in 1933 to below 10 percent in 1936, if you count those employed by the government as employed, which they surely were. In 1937, Roosevelt tried to balance the budget, the economy relapsed again, and in 1938 the New Deal was relaunched. This again brought unemployment down to about 10 percent, still before the war.

The New Deal rebuilt America physically, providing a foundation (the TVA’s power plants, for example) from which the mobilization of World War II could be launched. But it also saved the country politically and morally, providing jobs, hope, and confidence that in the end democracy was worth preserving. There were many, in the 1930s, who did not think so.

What did not recover, under Roosevelt, was the private banking system. ... If they had savings at all, people stayed in Treasuries, and despite huge deficits interest rates for federal debt remained near zero. The liquidity trap wasn’t overcome until the war ended. It was the war, and only the war, that restored (or, more accurately, created for the first time) the financial wealth of the American middle class. ... But the relaunching of private finance took twenty years, and the war besides.

A brief reflection on this history and present circumstances drives a plain conclusion: the full restoration of private credit will take a long time. It will follow, not precede, the restoration of sound private household finances. There is no way the project of resurrecting the economy by stuffing the banks with cash will work. Effective policy can only work the other way around.We have to realised that credit and banking feeds off global real economy. It is actually a cost, however small, for the real economy. So once jobs come back and incomes stabilize (at whatever levels), you will see credit coming back. Without certainity of earnings, the credit channel goes in self-preservation mode - waiting for certainity to return. Being global, the channel can absorb far more bailout/stimulus than any single nation can provide.

The problem of global income adjustment and therefore credit offtake ability will hit us next. This is the heart of the problem. Next: we will see how we can fix this!

Global crisis is a result of three elements freezing together - an overleveraged buyer unable to buy more, a seller without access to credit to create supply and non-existant market where no one trusts anyone.

We cannot fix all three together as all three elements are vastly globalised and hence too big to fix all at once. So it makes sense to get back to basics. The entire economic system was created with demand at the center. When demand existed - supply emerged and market appeared to match producer and consumer. So we need to fix demand first, help supplier get started and things will start taking care of itself. But!

First lets get demand straightened out. Demand in recent past was excessive - it will never be that high any time soon. But however small - we need it. Demand comes from wages and employment certainity. This is the basic of Keynesian stimulus - create jobs system will fix itself. So this would have solved our problem this time as well - had it not been for credit starved supplier.

The supplier, earlier, was driven by equity and debt was but a cash-flow smoothening mechanism. Then we realised the power of leverage to amplify returns, create surplus wealth thereby creating a separate investor class specialising in just providing capital unleashing entrepreneurial energy. This class made the entrepreneurs leverage themselves to the maximum possible limit. This culminates today into credit being necessary mana for the suppliers to produce goods. Without supplier there is no market!

The market essentially is an infrastructure provided to suppliers to help them address demand - through exchange of goods and services. Market works on marginal cost of exchange. Markets usually take care of themselves so long as demand and supply exists. The maximum fixing markets needs is through ensuring rule of law - enforcement of contracts, protection of aggreived, ensuring people don't cheat or muscle out others etc. Markets are even oblivious of fairness of law - so long as law exists and they get implemented markets will get created.

Hence the crisis will be resolved if we solve the demand (consumers') problem first. Then we need to fix suppliers' access to credit. It is ok to have latent unsatisfied demand - that often gets channeled into savings. But excess supply translates into inventories and they have costs and lead to supplier anemia. Ensuring law and order will help markets get back in shape soon enough.

US Solution has been antithetical to first principlesThe solution so far has exactly moved in opposite manner. We tried to make market functional by rough-shodding over contracts and ensuring cheater get away with it. We tried to ensure liquidity to help with supplier credit. All this while - the consumer is facing increasing credit card debts, lower job prospects and total loss of confidence in possible return to reality. We haven't really done anything to prevent creditors making predatory moves on consumers.

The solution to the crisis is essentially a modified Keynes' approach. We need to create jobs while fixing the system in coordinated precision. The kind that won Nadia Comaneci her perfect 10. And the stakes are higher there is not saffety net - no silver medal!

Given that real stimulus will take a form of modified Keynesian approach- we need to know what are the "highways" of today. During the last depression, the building of highway and rail infrastructure got the US out of trouble. This time, to my mind, it has to be Green and Blue infrastructure.

Going GreenUS has been victim of development invention. Most of the infrastructure / engineering of the country is based on older technology thats not green. Few years ago when the green revolution was knocking at the doorstep, it was difficult to see how US and developed world can re-engineer the entire setup to go green in a meaningful way. Luckily the current situation presents us with an opportunity to do just that. In doing so, US will lay the foundation for competitiveness for the coming decade or more while adding to comfort on global warming.

Going BlueWhile green is important, blue is even more so. By blue I mean developing potable water resources. Greening, apart from using lower emission fuels, also means creating tree cover and rebuilding green-ecosystems. Initiating this will require potable water sources. Further water is the most essential commodity for sustaining life. Investing in rain water collection ponds and lakes, water seepage assistance to rebuild ground water resources etc will have to take precedence. India has got an initiative off-ground through India water portal.

Implications for cities and homesteadsIf at homestead level we can create sustainable water and green infrastructure, we will have a much better self-sustaining planet. That imlies our city-oriented development models will have to be modified to make it more sustainable.

Implications for current economic slowdownThe ability of these initiatives to create jobs is under-rated. If properly deployed these initiatives may create more jobs and more self-satisfaction than most optimistic forecast. These initiatives have unique character. They need huge manpower up front and then possibly the overall manpower requirement for sustaining this effort will be about 3% of original. This means they can create enough jobs to reduce unemployment rates by some percentage points in initial years. And the man-power can be freed in few years as economic activity resumes full steam.

In SumGreen and Blue are compulsions. We either take up our share of responsibility or implications are large and life-threatening. As they say, "nature does not do bailouts". The opportunity has presented itself - lets grab it!