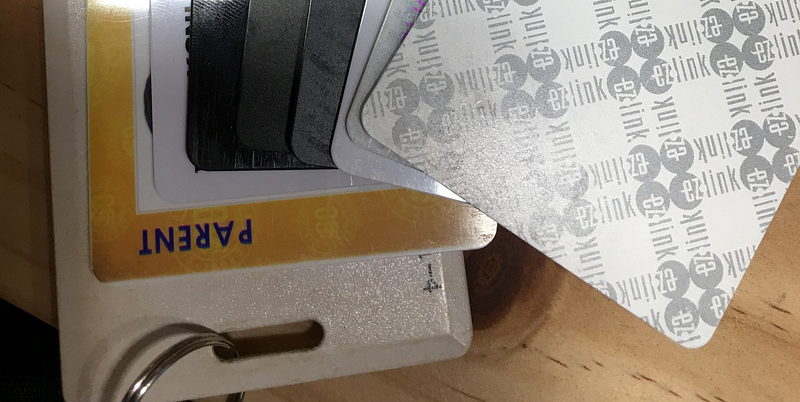

Everyone is familiar with the oyster card in London and similar cards world over. Singapore has its own ez-link card. Yet, I carry few debit cards, few credit cards, School Access card (for parents), the Museum passes, Office access card, home access card and the works. There are simply too many cards.

Too many cards that I carry SIGH!

Too many cards that I carry SIGH!

How about just 3?

Is it difficult? Not at all. Let us imagine 3 cards. One is your all-in-one Government ID. Second is high-security-access card (HS Card)— used for all debit card / credit card processing/home access and the like. Third is a lower security card (LS Card) — pre-paid cash card, travel, office access and the like.

Well, this system is in fact easier and more cost effective to setup. The service provider (say a bank, home security system) need to do is to add the card number and details present on the face of the card itself to their system and bingo your card can now function as a Citibank, HSBC or Chase or whatever card you prefer. On the back of the card they can stick a little sticker so that I remember what cards option I have. By limiting its access you can control what data the “swiping device” can collect. So one way could be to use photo of the card. Other way would be to simply tap that card — this would allow basic data for shopping say upto $2000/-. A swipe would let you swipe more than $2000 till your limit. A house access would require a tap and pin (say).

Same goes for the LS Card too. In fact all the shops who want to give you “points” and reward your “loyalty” can do so with this LS Card. Anyone wants you to give access can enter this card number in his system and you will have access to it. This could be transport systems including taxis and buses, boats and the works. It could also be your office door etc.

The government ID card can be kept separate because of the legal issues that result in case of mishandling of the card. If some vendor makes a mistake you may lose access to your insurance or something far worse — you may no longer be a citizen. The redundancy allows for the system to be more stable than depending on simply the transaction card.

Who mentioned Apple Wallet or Android Pay?

At its best I would have Apple, Android and mobile phone manufacturers do this. Just by getting my mobile number all the companies can give me access using the phone. I should be able to share basic data with companies wanting to reward me for my “loyalty” just by sharing my phone number and a sms based pin and then it should be easy for the companies to keep rewarding me.

However, I am wary of putting ever more power at the hands of these companies. For one, it seems difficult for these systems to work together at least till now. Therefore, we have cards that are not Apple pay compliant or the shops don’t have terminal for Apple pay. These problems are easily solveable — we simply need a will to do it. It would be beneficial if these companies adopt a universal standard for such operations.

This otta make cities Smart

Now I am not a fan of smart cities focussing on useless tech without convenience. But the smart card concept we discussed above seems to be practical and it should make cities smarter, peoples lives easier.

A city state like Singapore should initiate experiment in this direction. Singapore already has its own payment standard called NETS, formed by collaboration between various banks and adopted by monetary authority of Singapore. Now all cards should be NETS compatible — debit cards, credit cards and yes access cards, transport cards etc. With this in place we will take the first step towards card utopia.

Buy my books "Subverting Capitalism & Democracy" and "Understanding Firms".