It is that time of the year again when I take my crystal ball and peer into the future. So lets get going.

The hand that Yellen plays

I think overall theme of 2014 will be determined by the hand that the US Fed plays over the first two quarters. There are two reasons why I say that. Firstly, Janet Yellen is clearly from the Bernanke School and people expect the QE -based easy monetary policy will continue. Secondly, contra the above Yellen is talking about modifying the nature of QE to be more directed and precise. I think that is full of risks which market has not fully understood as yet.

QE till eternity? Almost!

One thing is clear you cannot have QE taper till you have sustainable employment with a visibility over say a 10-15 year period AND reasonably deleveraged US household. Once that is achieved then you can consider a talk of taper and the resulting volatility will be allayed by stronger household balance sheets and things can progress from thereon. So in effect the following things must happen:

- Employment must reach about 95% of the workforce. It should be reasonably certain employment.

- Ideally, US need to see emergence of a new industry which has three characteristics - first it fits with the US competitive character; second, it is a mass employer employing relatively lower skilled people and third it has second order, third order effects. Most likely that industry could be in renewable energy or water conservation space.

- There must be a reasonable clearing of Household debts and households must be reasonable deleveraged with margin to take on more debt if required.

But it won't happen in 2014

To gather up that kind of employment we need a Fiscal side action. A national overhaul of US infrastructure will raise my hopes though it does not promise the sustainable employment for at least 15 years. But it is a fair shot to say the least. The current Fiscal policy is far too short of any meaningful contribution in this regard.

Will QE lead to a US Inflation?

The whole idea of stimulus is that money will flow through the channel to the places where it can create value- therefore GDP growth- therefore jobs and this cycle will pull the economy out of the doldrums. Today the situation is different.

First it is difficult to keep injected money within the territorial borders to create the desired effect. This means two things. First the quantum of stimulus required will be far larger considering the wastage. Second, the problems of world have bearing on the quantum.

Second the mechanism of money flow or money flow channel is not functional so you cannot get the flow to the lower rungs (i.e. from asset investors to asset owners). That implies that the money is sloshing into restricted space. It is spilling into global asset classes searching for a channel to reach the bottom. (EM equities being one of them).

There are two things that must happen before the money starts getting channelized properly.

- You need and investable industry to crop up. And not any industry will do - it must employ relatively lower skilled people in large numbers. When we find such an industry (as a few are being experimented with) we will see money being rapidly absorbed.

- The current uncertainty of weak institutions collapsing must go away as in early investment stages any industry is quite vulnerable and ours will be no different. When there is adequate certainty that the weaker or failing institutions may be ring fenced into failing safely then it will start growing.

When growth gains traction it will lead to inflation. The trouble is that US FED does not want inflation but that inflation is decades away. But looking at that possibility it is doing nonsense like QE tapering etc. Naturally, if you want the industry to appear quickly then it is easier done through Fiscal policy than through monetary policy (no doubt monetary policy needs to be accommodative).

Therefore even inflation will not happen in 2014 and it is a good outcome.

The EU curve ball

I think the most weird scenario is that of European Countries. Some are following austerity, others are expanding and the effect is a mixed bag. In fact there is good chance that the next problem will arise in Europe rather than from US tapering.

I think there are more things fundamentally flawed in EU than in US. So I would bet on US in a US v EU debate. Further, I would be wary of developments in EU both political and economic because each has impact on the other.

Further, this problems may come to fruition in 2014. It could be the one almost certain headwind of 2014 unless some dramatic political strategies and monetary policies are put in place. The problematic part is that any meaningful resolution requires massive political coordination spanning different regimes that have different outlook to policies.

I think Martin Wolf has it right in his last video presentation here.

About Indian stock Markets

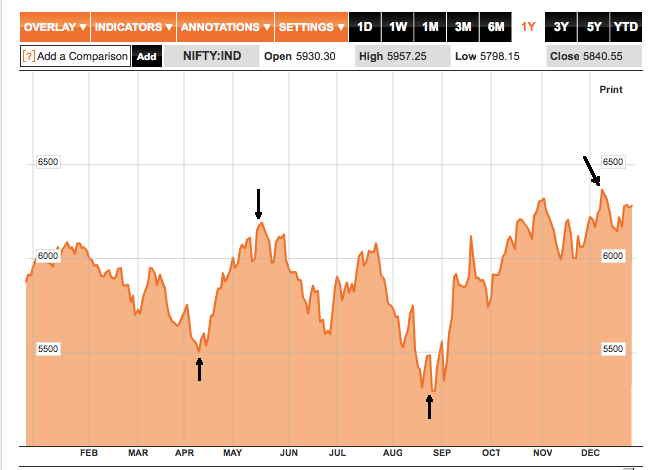

Indian stock markets are likely to move up till say Jan-Feb and then go through a period of extreme volatility related to elections and possibly few other global factors. The presence of strong and short cycles was critical feature of 2013. I believe this will continue in accordance with slosh-money hypothesis I explained in book and previously on this blog.

The flow and quantum of money means it will keep moving between various asset classes sloshing them with out of the world valuations and ridiculously cheap ticket sizes all in span of 4-5 months. 2013 we had 2 cycles in one year (2 peaks-2 troughs). In 2014 we will have at least 2 (2 peaks-2 troughs) and may be 2.5 (2 or 3 peaks and 3 or 2 troughs).

It means we need to be nimble in investment and must be ready to keep the money off the table. This, as I have experienced in 2013 is more difficult than it sounds. One need not be a daily trader, but the investment strategy must be tested more often than what we previously believed. The days of buy and hold are over and in fact buy and hold has become more destructive option today.

What about Gold and Oil?

To me it seems that Gold and Oil will not be as critical as thought previously. Gold will slowly gain traction and it will go past $3500. The nature and quantum of QE, already delivered and expected to be necessary, will have substantial bearing on the projected price of Gold. The forecast for medium term gold prices varies between $2000 to about $7000 primarily because the fact that the other side of the equation i.e. total amount of money in the system has a wide estimate. Once that clears up the Gold forecast will be much more saner. Having said that, the fact that the total amount of money in the system is unknown/varies drastically itself makes a case for Gold. Thus, I would be buying Gold if I was USD /developed economy buyer. In a different currency, the Gold trade may not be as compelling.

Oil may be more volatile in accordance with the QE news flow. Oil gaining its position as store of value (a story that had abated after Shale and other quasi-oil alternatives). Though Oil as store of value is likely to end disastrously. Oil is no longer the resource crunch story that it was between 2005-2010 period. We have never heard the real oil story. There is no dearth of oil if you set aside the environmental consideration and cost of drilling. So "Peak Oil" really refers to "Peak $50 Oil". The real constraints are in fact the environmental considerations and we may do well to move away from oil sooner than later.

War is coming

So long as US continues on its Japanese strategy, we are going to see possibility of war increasing. It is possible that China will induct 5-6 Aircraft carriers into its navy in 2014 if not more in preparation for war.

The new Chinese leadership will face tougher challenges converting its economy from a producer-driven economy to a consumer-driven economy. Further, the lack of sustainable global demand will not ease the pressure on Chinese government. When the problems of worker migration will ease the problems of worker wages will begin. It will take a great deal of proactivity on part of the new Chinese Leadership to manage these. Further, this is the first truly non-revolution leadership so we are yet to see their mindset.

All said, I see some notoriety involving Chinese sooner or later.

Finally,

As I head to the beach, let me say this, we seem to be in much saner times than we actually are. Insanity is quite a short jump from us at any time. So in such times let sanity prevail, let talents rise and pseudo-leaders fall and let peace be upon us.