We are at the threshold of 2015 with US posting one of the record quarterly earnings, FED talking of tightening, Russia and China on the brink of their own respective crises and some rather tricky security flashpoints - information security breaches and physical security breaches by ISIS, Boko Haram and the usual Al Qaeda and Taliban.

From the markets perspective, we have rather exhilarating ride. Oil prices have hit $60 from $100+ just a year back. Gold prices have softened, US markets are touching all time highs. EU is on the thresholds of a QE for itself. Japan has voted Abe back. Seems like good times are here!

Well they are! The recovery is thanks to the US Fed and so long as Fed does not tighten or initiates another form of QE, we can enjoy the benefits. It is time to make money and build up a solid rainy-day reserve.

The cycles and volatility are our friends

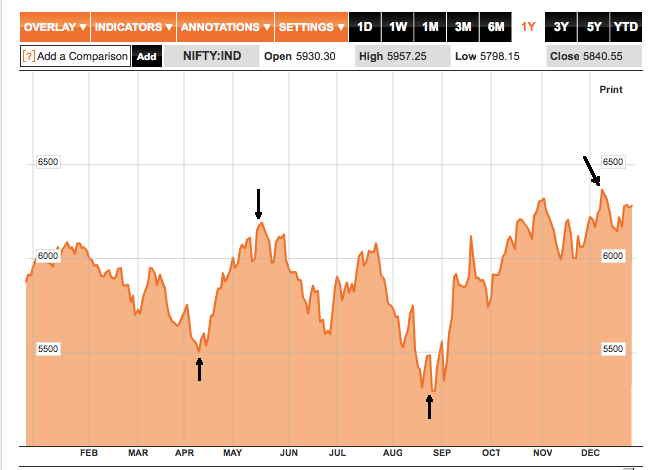

The year promises to be as cyclical and volatile as previous if not more. This year though I am expecting at least 3 full equity market cycles - as compared to 2.5 (3 peak-2trough or vice versa) I expected last year. Unlike last year though, there will not be a secular up-trend. Thus last year if we missed a peak it was easy to recoup the lost gains by simply waiting. This time we may see some losses in such scenario.

US and developed markets

In general I agree with the Jeremy Grantham's forecast that US markets may move till 2300 -2500 before any correction. His analysis is worth a read. Secondly there is nothing that can shake up the US markets in present circumstances. The shock, if it must come, must be substantial. I think the Fed must continue to be on a pause till the employment outlook improves. This will allow for the growth to get traction. In the early '30s US withdrew the stimulus too soon with disasterous effects. Therefore I presume they will err on side of caution this time around.

The EU on the other hand still sustains itself on internal trade and consumption. EU stimulus, when it comes will be of great benefit. Let us hope to get the mechanics of this stimulus right as EU is more vulnerable to a currency run than USD.

US and developed markets

In general I agree with the Jeremy Grantham's forecast that US markets may move till 2300 -2500 before any correction. His analysis is worth a read. Secondly there is nothing that can shake up the US markets in present circumstances. The shock, if it must come, must be substantial. I think the Fed must continue to be on a pause till the employment outlook improves. This will allow for the growth to get traction. In the early '30s US withdrew the stimulus too soon with disasterous effects. Therefore I presume they will err on side of caution this time around.

The EU on the other hand still sustains itself on internal trade and consumption. EU stimulus, when it comes will be of great benefit. Let us hope to get the mechanics of this stimulus right as EU is more vulnerable to a currency run than USD.

Indian Markets

In general, emerging markets will follow US markets. India should be special, and in general flight to quality to US should affect Indian markets to a lesser degree. Indian markets should have similar pattern like that of US - about 3 cycles over a secular uptrend. It seems 35K on Sensex does not seem out of reach. Within the broad Indian market uptrend we should see some sector rotation. Infra stocks should be back in favour along with asset intensive industries. Expect to see higher volatility in the markets thereby allowing for higher gains than the 27K-35K interval suggests. However, buy and hold will be a risky bet given sector rotation and global risks.

In general, emerging markets will follow US markets. India should be special, and in general flight to quality to US should affect Indian markets to a lesser degree. Indian markets should have similar pattern like that of US - about 3 cycles over a secular uptrend. It seems 35K on Sensex does not seem out of reach. Within the broad Indian market uptrend we should see some sector rotation. Infra stocks should be back in favour along with asset intensive industries. Expect to see higher volatility in the markets thereby allowing for higher gains than the 27K-35K interval suggests. However, buy and hold will be a risky bet given sector rotation and global risks.

The nature of risks from shocks

The year while positive is fraught with risks:

- End of ZIRP?: Yellen's comments in the last Fed meeting have prompted analysts to pencil in a Fed rate hike in calendar 2015. I find that hard to believe. In the very least we should see a prolonged ZIRP pause. We should expect a shock only around June if at all Fed decides to hike.

- Draghi - Will he won't he?: What Draghi does and when he does it will naturally have a lot of bearing on the nature of cycles. I suspect EU will ease before US tightens. The qantum of QE is likely to be lesser and more directed than US.

- Japan - Abe it is!: Japan has done quite a bit quite quickly. I think they will have to continue with it and make the stimulus, QE more directed using policy interventions. Japan will be more aggressive on investments across the world.

- Chinese growth: Analyst expect the Chinese growth to surprise on the downside. I am not sure about China but most likely the numbers may be better than analyst estimation. Lower Chinese growth implies easier commodity prices - sort of a QE by itself.

My Strategy for 2015

The buy-and-hold era ended in 2008. These days the best buy-and-hold stocks never reach the broader markets when there is still money to be made. They sit tight with PE or angel investments. The stock markets are being used by promoters as a sort of exit option. So indeed we must sort and sift through the stocks and keep churning as soon as they fall out of our valuation metrics.

Infra stocks: Infra stocks seem well set to make a comeback. I have been investing in them since 2011 hoping for Indian infra turnaround. The situation is more conducive than 2011 but I have been wrong before.

Commodity stocks: The China crisis seems to have sent some commodities in a tail-spin. Therefore I am not inclined to interfere with metals and non-perishable commodities. Other commodities - like sugar are weathering the oil price shock resulting in lower alcohol demand coupled with excess supply. Sugar should turn around soon. I have been investing in sugar since early part of this year. I will continue to add to my positions.

Banks and Commercial Vehicles: These stocks are leading indicator stocks and I have liquidated my positions in banks and will soon do so in Commercial Vehicles space as well. These two sectors are in for period of good growth and repairing of their balance-sheets. In that sense if there is any correction I will take substantial positions in these. They should turn around pretty quickly once the shock wears off.

Gold: Gold is the only buy and hold thing I can think of currently. Only if you are in a currency that has potential for appreciation vs the USD then you can ignore gold for short term. The current USD strength is good for buying gold. The currencies of economies where the private sector and consumer is not leveraged and public sector is reasonably benign will ultimately appreciate in relation to USD.

In Sum

The year promises to be exciting year, a rare patch in a lifetime where we can ride multiple cycles within a year itself. The experience of recent past tells us to be nimble with a healthy respect for cash. Let us see how we can capitalize on this coming year.

The buy-and-hold era ended in 2008. These days the best buy-and-hold stocks never reach the broader markets when there is still money to be made. They sit tight with PE or angel investments. The stock markets are being used by promoters as a sort of exit option. So indeed we must sort and sift through the stocks and keep churning as soon as they fall out of our valuation metrics.

Infra stocks: Infra stocks seem well set to make a comeback. I have been investing in them since 2011 hoping for Indian infra turnaround. The situation is more conducive than 2011 but I have been wrong before.

Commodity stocks: The China crisis seems to have sent some commodities in a tail-spin. Therefore I am not inclined to interfere with metals and non-perishable commodities. Other commodities - like sugar are weathering the oil price shock resulting in lower alcohol demand coupled with excess supply. Sugar should turn around soon. I have been investing in sugar since early part of this year. I will continue to add to my positions.

Banks and Commercial Vehicles: These stocks are leading indicator stocks and I have liquidated my positions in banks and will soon do so in Commercial Vehicles space as well. These two sectors are in for period of good growth and repairing of their balance-sheets. In that sense if there is any correction I will take substantial positions in these. They should turn around pretty quickly once the shock wears off.

Gold: Gold is the only buy and hold thing I can think of currently. Only if you are in a currency that has potential for appreciation vs the USD then you can ignore gold for short term. The current USD strength is good for buying gold. The currencies of economies where the private sector and consumer is not leveraged and public sector is reasonably benign will ultimately appreciate in relation to USD.

In Sum

The year promises to be exciting year, a rare patch in a lifetime where we can ride multiple cycles within a year itself. The experience of recent past tells us to be nimble with a healthy respect for cash. Let us see how we can capitalize on this coming year.

Buy my books "Subverting Capitalism & Democracy" and "Understanding Firms".